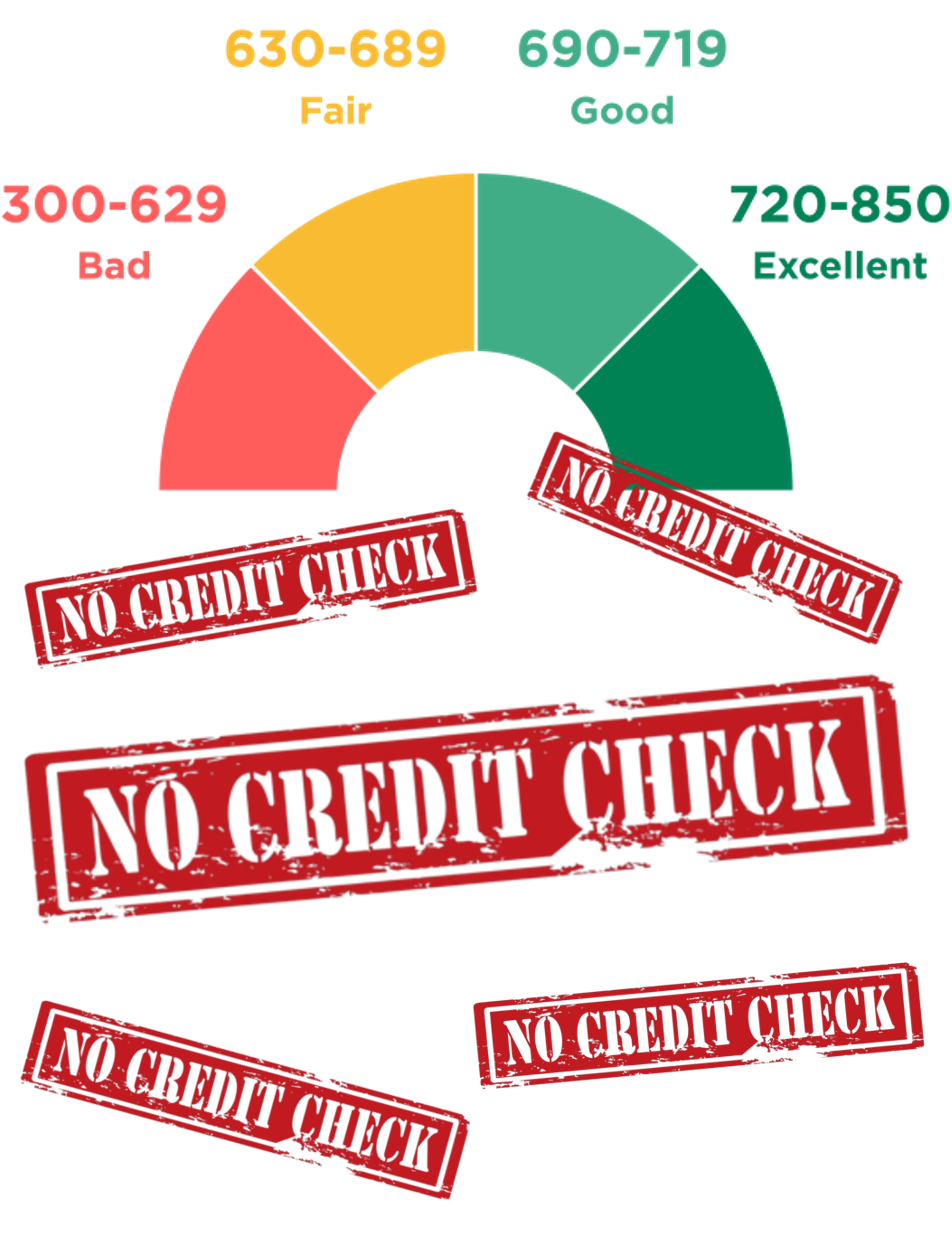

Your go-to source for financial products that don’t perform a hard pull on your credit report.

A “hard pull” or “hard inquiry” happens when lenders check your credit history before approving loans or credit cards, which can temporarily lower your credit score. Here at NoHardPull.com, we focus on products that only require a “soft pull,” meaning you can explore financial opportunities without affecting your credit score. Whether you're looking for credit cards, loans, or personal financing, we've got you covered with options that won’t impact your score, so you can make informed decisions confidently.

Discover a range of business credit cards that help you build your company’s financial future—without impacting your personal credit score. Our selection of "no hard pull" credit cards allows you to apply with confidence, knowing there’s no risk to your credit. Find the perfect card for your business below!

The Credit One Bank Platinum Visa offers pre-qualification with no impact to your credit score, making it a solid choice for those seeking to build or rebuild credit without a hard inquiry.

Get started now ❯

The Upgrade Card combines the flexibility of a credit card with the predictability of a personal loan, offering pre-approval with a soft credit check, ensuring your credit score remains unaffected during the application process.

Get started now ❯

The Self Credit Card is designed for individuals building credit, offering a secured credit line without a hard credit pull, making it accessible for those starting their credit journey.

Get started now ❯

The Discover it® Secured Credit Card provides a path to build or rebuild credit, with pre-qualification options that do not impact your credit score, allowing you to check your eligibility without a hard inquiry.

Get started now ❯

The Chime Credit Builder Visa® Credit Card is a secured card that doesn't require a credit check to apply, making it an excellent option for those looking to build credit without a hard pull.

Get started now ❯

Get the capital your business needs without the hassle. Our selection of business loans offers flexible options, from working capital to equipment financing, all designed to help you grow. With no hard credit pulls, you can explore funding options without impacting your personal credit score.

OnDeck offers business loans with a simple application process that includes a soft credit check, allowing you to explore funding options without impacting your personal credit score.

Get started now ❯

Nav provides personalized financing options for businesses, matching you with lenders that perform soft credit inquiries, ensuring your credit score remains unaffected during the exploration phase.

Get started now ❯

LendingTree connects you with multiple lenders through a single application, utilizing soft credit pulls to present personalized loan offers without impacting your credit score.

Get started now ❯

Our business banking options provide you with secure, no-fuss accounts that keep your finances organized and accessible. Whether you’re starting fresh or expanding, these accounts come with essential features tailored to business needs. No hard pulls, no hidden fees—just straightforward banking solutions to keep your business running smoothly.

GO2bank offers a high-interest savings account with no credit check required, providing a straightforward banking solution without impacting your credit score.

Get started now ❯

SoFi provides a range of banking services, including checking and savings accounts, with no hard credit pull required for account opening, ensuring your credit score remains unaffected.

Get started now ❯

HSBC offers a variety of banking products with an easy application process that doesn't require a hard credit inquiry, making it accessible for those mindful of their credit score.

Get started now ❯

These accounts allow you to purchase now and pay within 30 days, giving you breathing room to grow your business and establish a solid credit profile. Perfect for new and growing businesses, Net 30 accounts help improve credit without a hard pull, opening doors to larger funding opportunities as your business credit profile strengthens.

JJ Gold International provides Net 30 accounts to businesses, allowing you to purchase now and pay within 30 days, helping to build your business credit without a hard inquiry.

Get started now ❯

The CEO Creative offers Net 30 terms to qualifying businesses, enabling you to manage cash flow effectively while building business credit, with a straightforward application process.

Get started now ❯

Crown Office Supplies provides Net 30 accounts, reporting to major business credit bureaus, helping you build your business credit without a hard inquiry.

Get started now ❯

Quality Direct to Garmet Prints, Made in house, on NET 30 Terms enabling you to purchase and pay within 30 days, assisting in building your business credit without a hard pull.

Get started now ❯

Coast To Coast provides Net 30 accounts for businesses, allowing you to order supplies and pay within 30 days, helping to establish and build your business credit profile.

Get started now ❯

Enhance your store or showroom with custom script lettering that captures your unique style and makes a bold impression pay within 30 days to helping to establish your business credit profile.

Get started now ❯

Buy now, pay later within 30 days. We offer top quality goods for your office needs, your partners and loved ones. Our selection is diversified and getting bigger every day.

Get started now ❯

A legally registered company that has been “aged” over time but has remained inactive until it’s acquired. Owning a seasoned corporation allows business owners to start with an established entity, making it easier to gain credibility, secure financing, and build trust with clients and vendors.

Learn how to get $100,000 without income or collateral in 7 days! Discover the step-by-step blueprint to easily get funding for your business or real estate.

Studies show that over 50% of business loan applications are rejected due to insufficient business credit history or a low business credit score. Establishing a strong business credit profile early can significantly increase your chances of approval, as lenders often look at business credit to assess the financial health and credibility of a business.

We have the most powerful solution to dispute issues on your credit reports and improve your scores. We identify even the most subtle disputes – to leverage all opportunities to clean up your reports and raise your scores. Our industry leading 45-day dispute cycle is one of the fastest in the industry. No levels or upgrades needed. Say hello to peace of mind.

get STARTED now